Digital transformation and access governance in the banking sector

HSBC, one of the world’s largest banks, faced significant challenges in compliance and access in a highly regulated environment. The need for a solution capable of simplifying and securing its processes led to the adoption of ROK Solution.

HSBC in figures,

highlighting the scale of its network and operations

Largest bank in the world

Employees in France

Branches in France

Navigate through

a regulatory maze

Accounts certification and procedures

Ensuring the integrity and certification of financial and operational processes.

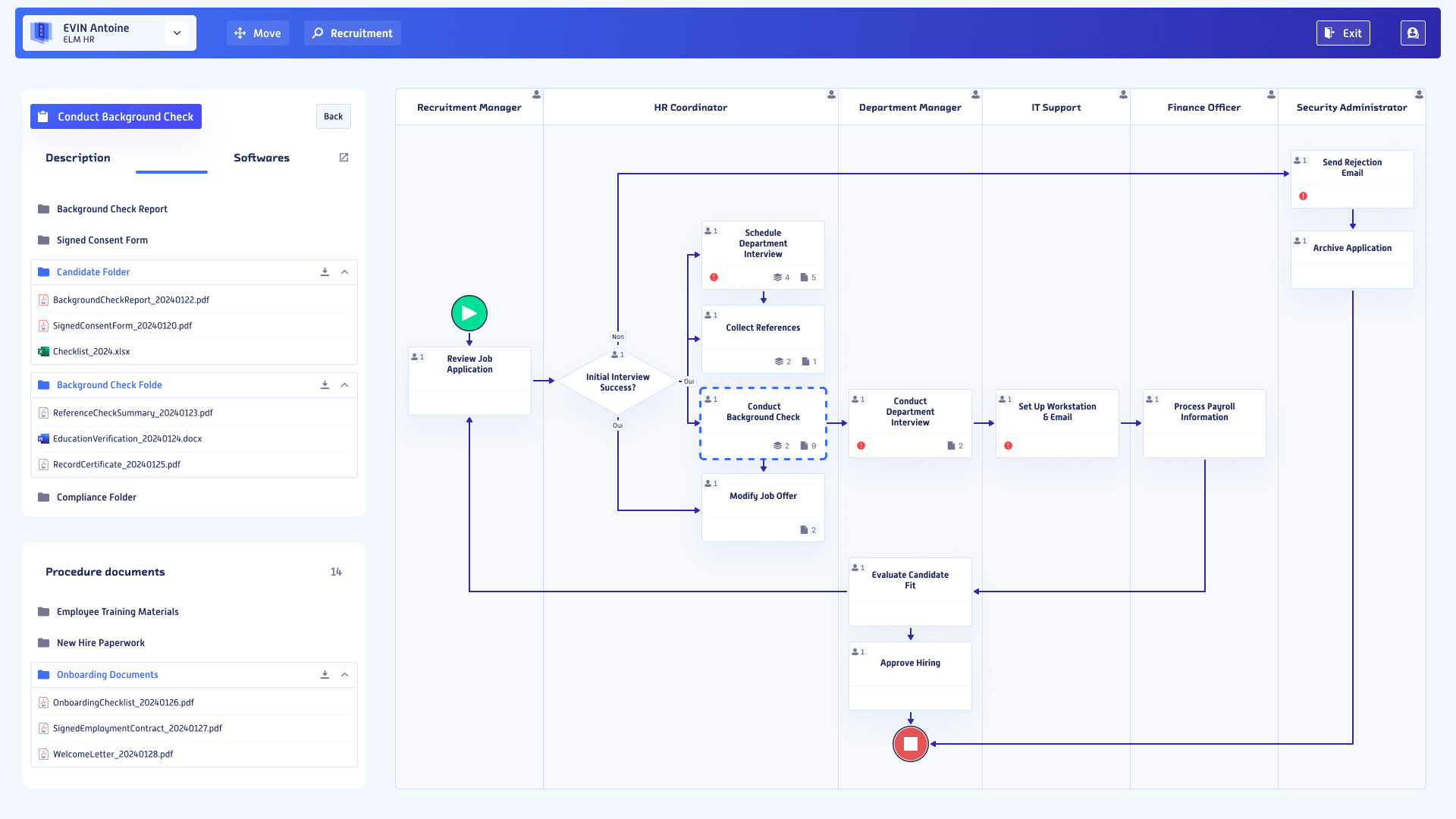

IT independence for updating workflows

Enable HSBC teams to manage workflows without external IT dependency.

Mastery of financial and legal risks

Ensuring full compliance with banking sector regulations.

Optimize identity and access management with our dedicated IGA solution, and create custom procedures and applications with our no-code & Generative AI modules!

The ROK Solution

Compliance and secure access

The ROK Solution has centralized and secured access to 1,300 business procedures (+2000 documents) for 7,000 agents, covering all aspects of banking.

Advanced user interface

A one-stop platform has been implemented to map and document procedures, significantly improving access and information management.

Winner of the 'Finance Innovation Trophy' Award

The deployment of ROK was honored with the first Prize of the ‘Finance Innovation Trophy’ for its unique support to the financial sector.

Key benefits for HSBC

Improved audits and error reduction

HSBC’s audit results have improved, exceeding Basel III requirements, and error processing time has been significantly reduced.

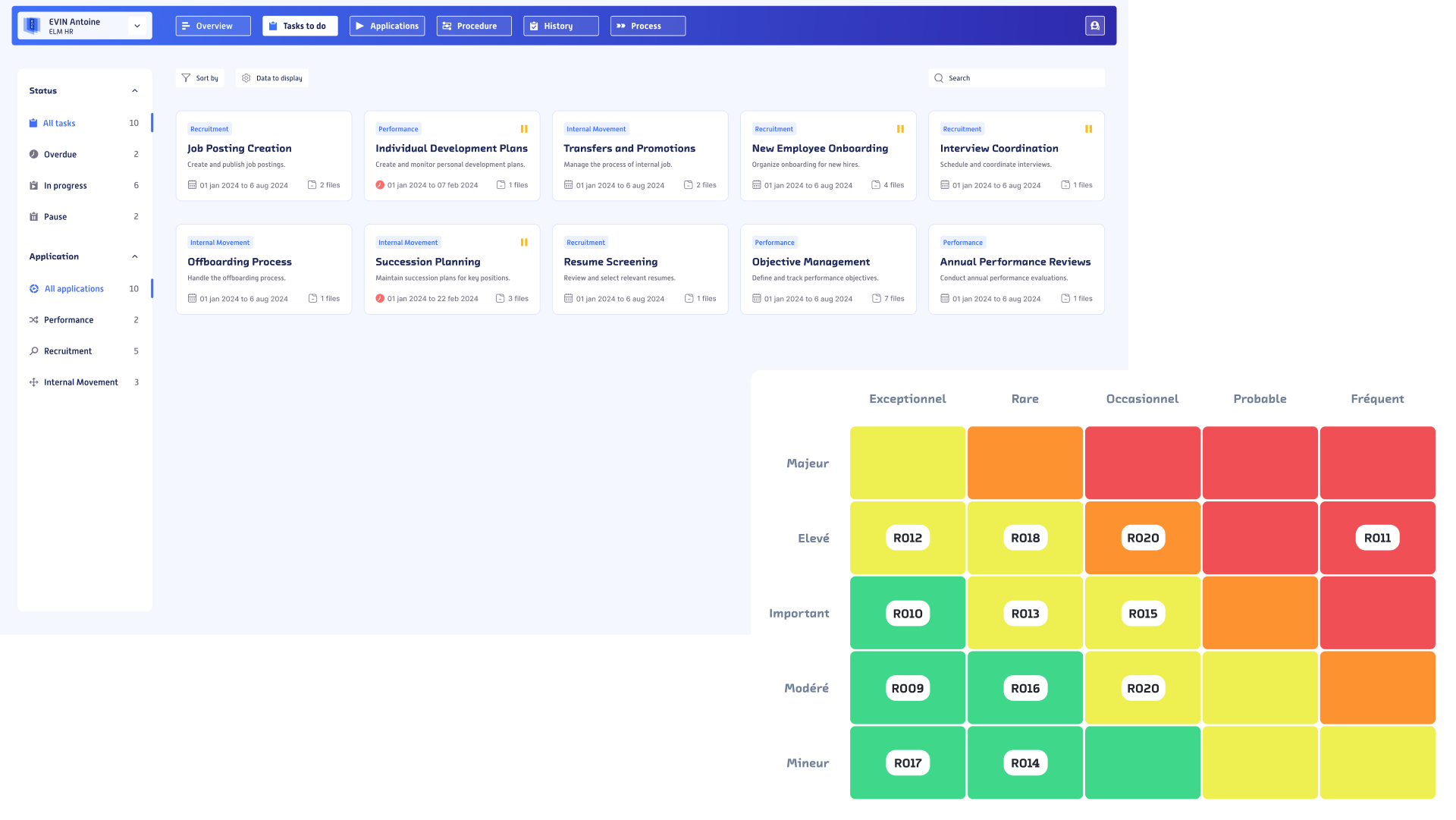

Risk management and transparency

A publication process has enabled continuous control involving key collaborators and increased transparency, strengthening risk management and compliance.

Accessibility and version control

HSBC’s repository has become easily accessible to auditors, ensuring transparent management and accurate documentation of changes. Facilitation of ISO 9001 best practices application.

Go ahead and get started right now!

Learn more: Access governance and financial compliance for banks

Intelligent access orchestration and banking compliance at HSBC

In a banking environment subject to strict regulatory requirements, critical access security and IT compliance are strategic priorities. HSBC, a major player in the financial sector, chose ROK Solution to automate its access rights management, strengthen its security posture, and meet ever-evolving regulatory demands.

The implementation of intelligent orchestration of banking roles and privileges has enabled HSBC to precisely control authorizations granted to each user—whether internal staff, service providers, or mobile users. Access rights are now managed dynamically, based on roles, projects, or business constraints.

This approach is part of a broader objective to reduce IT risks, particularly regarding residual or excessive access, which are often identified as major vulnerabilities during security audits.

Digitization of critical access and banking governance

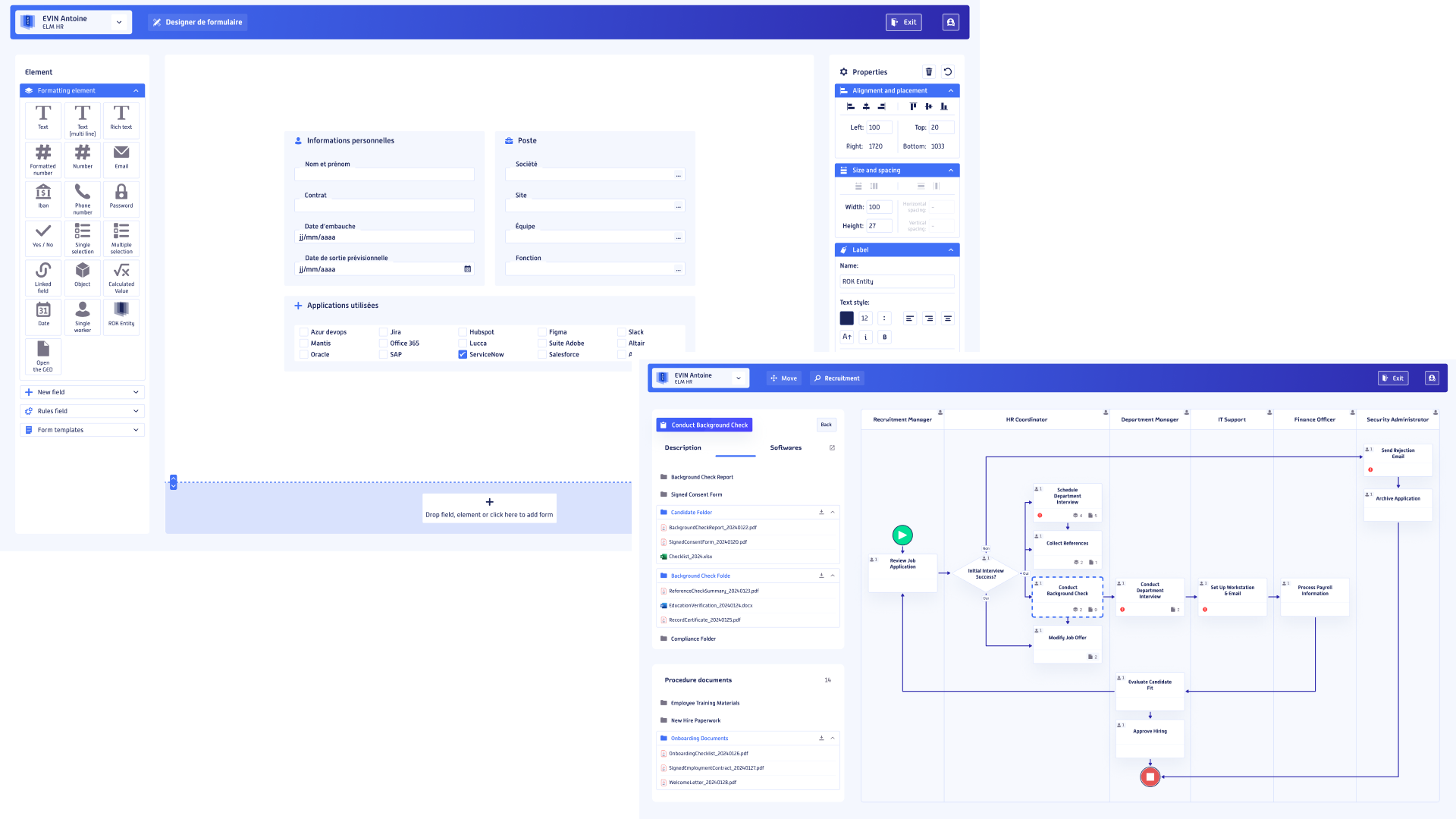

In the financial sector, the digitization of sensitive processes cannot be considered without full control over roles and approval workflows. HSBC integrated ROK to gain complete control over access to strategic banking systems, while automating low-value manual tasks.

The platform enabled centralized IT governance for banking, integrating all assignment rules, sensitivity levels, and traceability requirements within a flexible, scalable banking IAM system. Critical workflows were modeled to reflect internal realities: business roles, segregation of duties, and complex approval chains.

Thanks to ROK, HSBC is now able to identify compliance gaps in real time, adjust roles automatically, and ensure continuous alignment with banking industry standards.

The implemented solution is based on the security standards applicable to financial institutions, while offering great flexibility in integration with existing tools (HRIS, ERP, internal repositories, etc.).

Access rights automation and audit traceability in a regulated banking environment

In a highly regulated environment like that of a banking institution, access traceability and the ability to respond to audits are daily challenges. HSBC implemented dynamic role management with ROK, along with an alert system and automated reporting to detect any anomalies or excessive access.

The solution enables the security and compliance teams to view, in real time, the access rights granted to each user, track access history, and trigger automated periodic reviews.

Each granted right is now linked to a clearly defined role, an expiration date, and a validation workflow. All data is centralized in banking audit reports that can be used immediately during regulatory inspections.

With the integration of the module dedicated to access audit and regulatory compliance, HSBC has improved its responsiveness to regulator requests and strengthened its compliance with both internal and external standards (Basel III, ISO 27001, GDPR…).

Banking IAM and interoperable IT access governance

HSBC chose ROK not only for its robustness in banking IAM, but also for its ability to integrate with critical systems such as ERPs, sensitive databases, and internal financial repositories.

Access provisioning is now fully automated and connected to HR systems and business platforms. With every job change, project shift, or scope update, access rights are re-evaluated and adjusted automatically, in full compliance with SoD (Segregation of Duties) rules.

Integration with SAP and other financial ERPs was made easier by ROK’s modular design, built to support secure digitization of ERP environments. This native link between IAM and business applications ensures better authorization consistency, faster access provisioning, and greater operational agility.

All of this fits into a broader strategy to modernize, simplify, and secure banking information systems.

Generative AI applied to access security also enables the security team to automatically create assignment scenarios, suggest role optimizations, or enhance detection models in a demanding banking environment.

Thanks to a no-code process modeling interface, validation, provisioning, or deactivation workflows can be customized to local constraints, with no custom development required and full autonomy for operational teams.

This project is part of a broader strategy for secure digitization of business processes, placing access governance, IT compliance, and intelligent automation at the heart of transformation for large financial organizations.

Toward secure, agile, and compliant banking IT governance

Thanks to ROK Solution, HSBC has implemented intelligent access orchestration, tailored to the bank’s operational, regulatory, and security challenges.

The results are clear:

- Reduction of residual access rights

- Automation of access cycles

- Shorter processing times for requests

- Improved visibility on IT risks

The platform acts as a lever for end-to-end banking access management, while providing the flexibility required by large organizations.

This project is fully aligned with the bank’s strategy for securing IT systems, driven by the group’s cybersecurity, IT, and compliance teams.

To explore more feedback on the digitization of access in financial institutions, you can visit ROK Solution’s full collection of client success stories.